Brookfield Infrastructure Partners (BIP) Q4/25 Thoughts: Growth Re-Accelerating

Steady execution today and, more importantly, clear signs that growth is about to pick up again.

Beat the TSX-27 Strategy

Feb 04 2026

The BTSX27-Investor Highlights

Q4/25 FFO: $0.87(US) per unit

17 years of distribution Increases: 2026, 6% to $1.82US/year

2026 FFO Growth Outlook: 10%+ (inflection year)

Transaction Momentum: Strong in 2025, accelerating into 2026

AI / Data Center Exposure: 230MW secured with hyperscalers

Capital Recycling: $150M Brazilian asset sale (45% IRR)

Liquidity: $2.7B at the corporate level

Current Yield: BIP.UN 5% (Top 5 on the TSX60)

Valuation: Trading below long-term mid-range

See the Verdict Below

What Happened

Q4 was steady and predictable, exactly what we want from BIP. FFO came in at $0.87 per unit, and the annual distribution was raised by 6% to $1.82. Organic growth and recent acquisitions did the heavy lifting, partially offset by asset sales tied to ongoing capital recycling.

The more important message was forward looking. Management reaffirmed that FFO growth should re-accelerate to 10%+ in 2026, driven by new investments coming fully online and a growing backlog of data related capital spending.

Translation: the earnings engine is warming back up.

Growth Engine: M&A + AI Infrastructure

Back in October 2025, we wrote a one off article making a case why BIP is one of our top picks on how to play the AI boom: Brookfield Infrastructure: The Compelling Growing Dividend, GARP and SWAN company. We still feel that way today and now the numbers are starting to prove our thesis (which is nice!)

Transaction activity picked up meaningfully in 2025 and that momentum has carried into 2026. A standout example was the first project under BIP’s framework agreement with Bloom Energy, delivering 55MW of behind-the-meter power to a U.S. data center. Since then, additional hyperscaler projects have been secured, bringing total capacity to roughly 230MW. This is a great example of “ But they have a ton a debt and levered to the gills” Yes, they do and are. They also have secured long term contracts to back those up of which are tied to essential services and inflation protected.. Its called a spread.

Another observation and just as important, capital recycling is working exactly as designed. The sale of a Brazilian electricity transmission asset generated a 45% IRR, and management is monetizing stabilized North American data centers to fund the next wave of development.

Rinse. Repeat. Compound.

AI Infrastructure: Upside Without Losing Sleep

BIP outlined a disciplined approach to AI and data infrastructure that prioritizes downside protection:

Long-term contracts with capital recovery built in

Strong, investment grade counterparties

Prime, workload agnostic locations

Partial monetization of stabilized assets to manage exposure

Capital structures matched to contract duration

Translation: they want the upside, without betting the farm.

***Disclaimer: We normally don’t add this section and strongly recommend you do your own due diligence. Below is for entertainment purposes only.

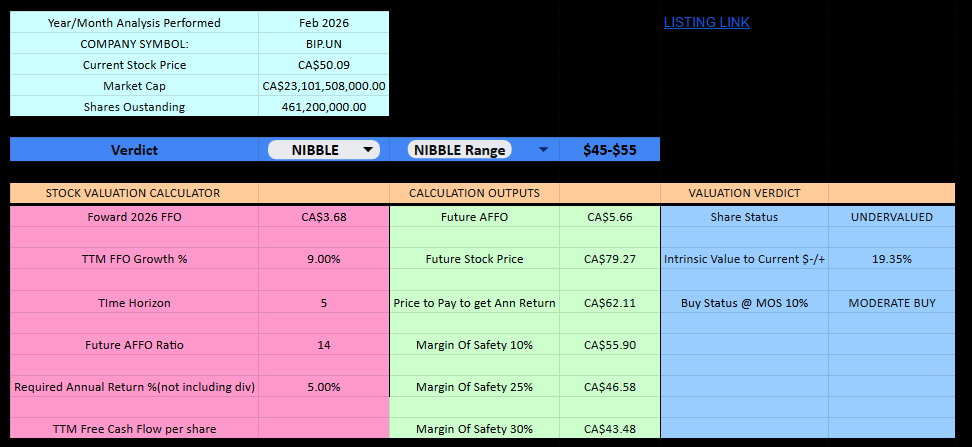

Stock Valuation :

At roughly a 5% Dividend yield for BIP.IN, 3.75% for BIPC, we find a 10x forward FFO, quite attractive and a little puzzled as to why its trading lower compared to its long-term range valuation range. And yes, we are saying that as it hits it 52 week highs. Stock market aside, we on the conservative side, think BIP.UN is a $80 in 5 years.

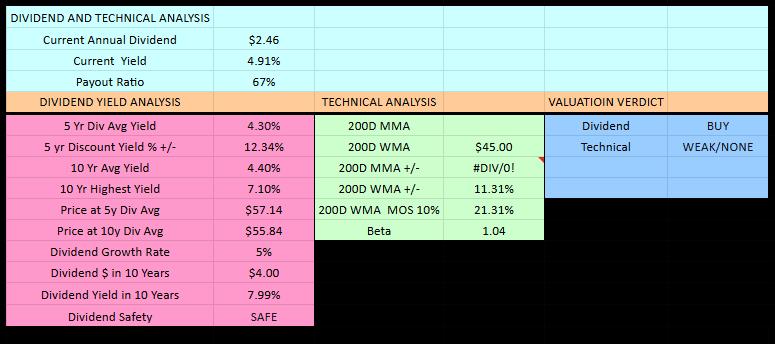

Dividend Valuation:

We will let the 17 years of 6%+ dividend increases to talk about this section. As a side note: Stay invested for 10 years and at a discounted dividend increase of 5%, you could be yielding 8%. (Pretty solid approach if you are about to or are in retirement)

Buy, Sell, Hold Verdict: BUY

Things get a little confusing in this section as we own BIPC in our non registered accounts and BIP.UN in our registered account

Our average cost BIP.UN: $38.96, Our yield: 6.31%, Portfolio Weight: BIP.UN, Deemed overweight at 6%

Our average cost BIPC: $45.48, Our yield: 5.4%,Portfolio Weight: BIPC, Deemed overweight at 11%

YTD Performance: 6.92%, TSX60: .34%

Look, for us, this is a strong hold and the “strong” is emphasized by the high portfolio allocation. If we were a new investor to the BIP world, we would take a nibbling approach. Not because of the valuation but more of the PE ratio of 21 for the TSX. In our opinion, that’s bubble territory. A PAC via a broker who doesn’t charge trading commissions could be a win/win approach. We use and find Wealthsimple very user friendly, especially in the Pre Authorized Contribution approach as you can purchase fractional shares. Pick X dollars a day and let the platform work for you. Referral Code

If you own it, hold it.

Nibble If you don’t

Final Thoughts: The Inflection Is Coming

Steady execution today and, more importantly, clear signs that growth is about to pick up again.

BIP is entering 2026 with:

Faster earnings growth

Strong transaction momentum

Active capital recycling

A covered and growing distribution

Inflation protected assets.

That’s a powerful mix.

For BTSX-27 investors, BIP remains a core infrastructure compounder, one that pays you well while you wait for growth to re-accelerate.

Have a fantastic week!

Keeping It Stupid Simple.

Thank you. If the attractive spreads deplete, they will just deploy capital somewhere else. BIP has and always pivot to where the puck is going, not where its been imo.. thank you for the comment.

Solid breakdown of the AI infrastructure play. The detail on how BIP structures these deals with long-term contracts and capital recovery baked in is really helpful for understanding the risk profile. One thing I've been watcing with their capital recycling approach is wether they can consistently deploy at attractive spreads as competition for data center assets heats up, but the 45% IRR on that Brazilian sale suggests they're still finding inefficiencies. The fact that FFO growth is re accelerating to 10%+ feels significant.