The Best Way to Invest: A Statistical Guide for Canadians

Invest early. Stay invested. Diversify. Don’t be a drama queen. Keep it simple

The Best Way to Invest: A Statistical Guide for Canadians

Introduction: Maple-Flavoured Money Wisdom

Investing is a bit like making poutine — part recipe, part instinct, and a whole lot of not screwing it up. There’s no magical strategy that works for everyone (unless you count buying land in Muskoka in 1974), but the right stats can help us cut through the crap and Bay Street baloney.

Whether you’re a retiree counting your dividends like loonies in a coffee can, a 30-year-old stacking your TFSA like it’s hockey cards, or someone who still flinches when you hear the word “Nortel,” the key isn’t to outguess the market — it’s to build a plan that survives it. Like a good parka in February, it doesn’t have to be flashy. It just has to work.

In this article, I’ll dig into what actually works for Canadian investors — using real data, real psychology, and just enough data to get the old brain rolling. By the end, you will get an idea what works, what doesn’t, and why boring (like curling on a Sunday) often beats chasing the next hot stock like it’s a Tim Hortons Roll Up the Rim prize.

1. The Case for Staying Invested

Let’s start with the most basic principle: time in the market beats timing the market. Let’s be honest, most people can’t time their microwave popcorn perfectly, let alone the stock market.

Stats That Matter (U.S. & Canada Similar Trends)

S&P/TSX Composite Index (2000–2024):

CAGR: ~6.7%

Worst year: -33% (2008)

Best year: +30% (2009)

I couldn’t find any TSX statistics, however according a JP Morgan 2023 Study:

Missing the 10 best days in 20 years cuts your return in half.

Missing the 30 best days drops your return to nearly zero.

Moral of the story: The best days often follow the worst. If you try to avoid volatility, you may miss the upside.

2. The Importance of Asset Allocation

How you divide your money between stocks, bonds, and cash matters more than which stocks you pick.

Asset allocation explains 90% of long-term portfolio returns.

Example Portfolios (Canada):

What It Means

100% Stocks:

Best long-term growth (6.7% CAGR). Still a crap return IMO and buy TSX Index ETF’s

Most volatile: large swings (high standard deviation).

Painful during crashes: max drawdown -33% (e.g., 2008, COVID crash).

60/40 Balanced:

Lower return than 100% stocks, but smoother ride.

Max drawdown is nearly half of a pure stock portfolio.

Standard mix for “moderate” risk investors.

100% Bonds:

Safe but limited growth (below inflation-adjusted needs).

Smallest drawdowns — best for capital preservation or very short time horizons.

3.6% CAGR barely keeps up with inflation over time and quite frankly if monies are in non registered account, the old tax man becomes the hangman.

Key Insights for Canadian Investors

Risk-reward tradeoff is real: Doubling the return from bonds (3.6%) to stocks (6.7%) means tolerating 5× the drawdown.

60/40 portfolios still work: Balanced funds offered smoother compounding with acceptable long-term performance. However, Imo 80/20 portfolio is superior.

Inflation matters: Even 3.6% bond returns may underperform inflation (especially in Canada, where CPI has averaged ~2.1–2.3% over 30 years). Add interest tax and you pretty much just signed up for a REAL loss

Volatility ≠ risk: As long as you stay invested, high volatility doesn’t always mean high risk — it may mean higher opportunity.

Food for thought: Your mix of equities and bonds should reflect your risk tolerance, not your FOMO. More on this below. Being to conservative, is actually signing up for a loss before you even get started. 100% GIC’s portfolio for example is not a prosperous long term adventure. By the time you pay tax on income and add inflation, is the GIC rate greater than the outcome? NO

3. Diversification: Free Lunchish, But Watch Your Calories

Warren Buffett famously said, “Diversification is protection against ignorance.” And in Canada, it's absolutely necessary—because our stock market is dangerously concentrated.

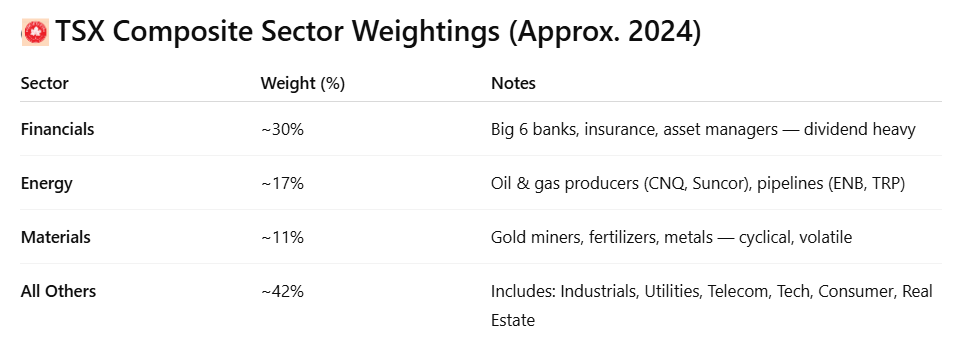

Canadian Market Concentration

Solution: Global Diversification

Adding U.S. and international equities reduces risk and boosts return.

Example: A Canadian-only investor (2000–2024) underperformed a globally diversified investor by ~1.5% per year.

That’s a 40% difference in wealth over 25 years—just for leaving your maple syrup bubble.

4. Dividend Investing: Income with Discipline

Canadian investors love dividends—and for good reason.

Why It Works:

Dividends provide predictable cash flow.

Forces discipline—investors are less likely to sell quality dividend stocks.

Many dividend payers are blue-chip companies and have grown their dividends for decades (e.g., RY, BN, Fortis).

Built-in inflation fighter (#1 reason why retirement funds fail)

BTSX-20(Beating the TSX Strategy)

Invest in 20 highest-yielding TSX 60 stocks annually.

Historical CAGR (1986–2024): ~11%

TSX Composite CAGR over same period: ~7.8%

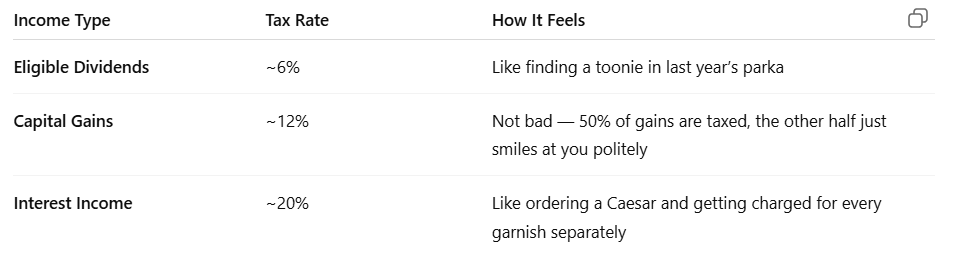

Bonus: Dividends — The Maple Syrup of Tax Efficiency

Let’s talk about taxes. No one likes them — not even accountants (and they literally get paid to think about them). But if you’re earning income from your investments, how that income is taxed can make a big difference to how much ends up in your pocket... or your RRSP... or your next RV trip to PEI.

Here’s what you’re looking at in Ontario in 2024, assuming you're pulling in about $50,000 in income:

In other words, Canadian eligible dividends are the most tax-friendly type of income this side of a tax-free Timbit.

So if you’re choosing between earning dividend income, clipping bond coupons, or stashing cash under your futon, remember this: dividends let you keep more of your hard-earned loonie — and that’s a strategy even your grumpy uncle with five GICs can toast to.

5. Indexing: A Simple Strategy Most Investors Ignore

The data is undeniable: Index investing consistently beats most active strategies—especially over the long term.

Over 85% of Canadian equity fund managers underperformed the S&P/TSX Composite over 10 years.

In U.S. equities? It’s worse—95% underperformed over 15 years.

Why?

High fees

Trading costs

Human error

2 of the Best All in One, 100% Equity Canadian ETFs:

HEQT – Global X All-Equity Asset Allocation

XAW – Global ex-Canada

I own HEQT (better performance and pays monthly dividends).

It compliments my BTSX-27 Strategy extremely well and keeps it stupid simple

6. Behaviour Is More Important Than Brilliance

Even the best strategy will fail if you don’t stick to it. The #1 investor killer? Emotions.

Average investor return over 20 years: ~3.6%

Market return: ~7.5%

Why the gap? Panic selling, chasing performance, and bad timing.

Food for thought: Create a plan you can follow—not the one that looks best on a spreadsheet. Don’t let your emotion determine what appetite of risk you should except. Like I said above, being to conservative can sign up to a losing war right from the gate. Work backwards by understanding what you need(assets, rate of return and time, etc) will help you understand how your portfolio should be constructed. Then just add that hot sauce of discipline and execution.

7. Automation and Dollar-Cost Averaging (DCA)

Instead of trying to time your way in, just automate contributions. With platforms like WealthSimple, you can easy setup daily contributions. Kind of like going to work everyday and making sure your future is getting paid.

DCA Benefits:

Reduces timing risk

Smooths out volatility

Encourages discipline

Observation:

Invest $125/week into an ETF returning 7%

After 30 years: $660,000

Food for thought: Even if your full time job pays $20/hour. $125 per week to achieve a sizeable retirement nest egg is not out of reach for most Canadians. Especially those who pro-actively complete a financial plan, once again, working backwards!

P.S HEQT has averages 12.35% per annum since inception. That’s $2,046,000.00

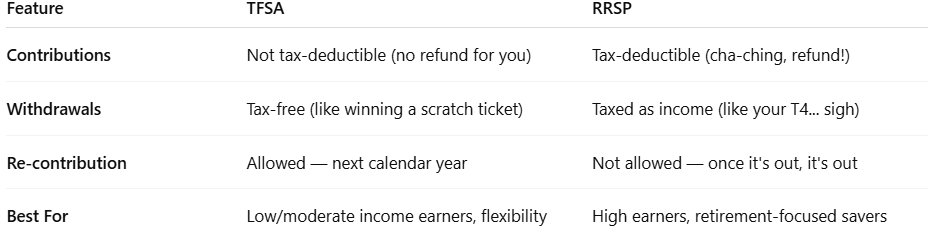

8. TFSA vs. RRSP: A Friendly Faceoff

When it comes to tax shelters, Canadians really only have two weapons: the TFSA and the RRSP. Think of them as the Crosby and McDavid of investing — both talented, both useful, but they play different roles.

Here’s how they stack up:

TFSA vs. RRSP Summary:

Strategy:

Use RRSP when income is high, TFSA when it’s low.

Always reinvest refunds from RRSPs—don’t spend them!

9. Avoid the “I Screwed Up” Trifecta

It’s not just about what you do—it’s about what you don’t do.

Common Investor Pitfalls (with real consequences):

Panic selling: Selling during COVID in March 2020 meant missing a 50% rebound.

Overtrading: Active traders earn less than half what buy-and-hold investors earn, on average.

Chasing hot sectors: Tech in 2000. Crypto in 2021. Weed stocks in 2018. History repeats.

10. Simplicity Beats Complexity

Don’t try to be a genius. Build a simple, repeatable system:

The “One-Fund Portfolio” Example:

VGRO or XGRO (80% stocks, 20% bonds)

Automatic weekly contributions

Reinvest dividends

Over time, this strategy has beaten 90% of active investors.

Conclusion

The best way to invest isn’t about stock tips, newsletters, or TikTok gurus.

It’s about EMPOWERING yourself by:

Creating a plan

Sticking to a plan

Keeping costs low

Staying globally diversified

Taking advantage of tax shelters, RRSP, TFSA and Dividends

Ignoring the noise

In other words, the best way to invest is also the simplest—but that doesn’t make it easy. Human nature, media panic, and short-term thinking will always tempt you to do the wrong thing at the wrong time.

But if you embrace a long-term, diversified, low-cost strategy—and stick to it—your odds of success skyrocket.

For me, HEQT etf and the BTSX27 Strategy gives me all the tools I need to accomplish my goals. Follow the above steps and odds are you will outperform 90% of all investors. It’s STUPID SIMPLE.